They have to pay for storage costs, insurance, rent, utilities etc. Typically, it is considered that if the inventory turnover ratio is high, it is better for the company. A low inventory turnover ratio means that the sales of the company are down or there is a decreasing demand for the goods. Most companies prefer using average inventory quantities because the average evens out sudden peaks and valleys from the changes during a certain period. For example, a certain day might have a sudden peak value in an otherwise normal month. Hence, average inventory gives a more balanced measure of the inventory.

Here, 1,00,000 (revenue – gross profit) is nothing but the cost of goods sold derived by unloading the profit margin from the sales. Before we apply the above formula, let’s understand the cost of goods sold, average inventory and how to determine these. The inventory turnover ratio is ranked above all other ratios because it enables a business to strategise in accordance with the results it computes. Every business inventory turnover ratio formula has inventory and its cash flow as its lifeline for earning revenue in the longer run. There are different methods and statistics which can be implemented to a balanced inventory cash inflow and productive sales for the business. Now that you have calculated the inventory turnover let us understand the significance of low inventory turnover, high inventory turnover, and their impact on your business.

Inventory Turnover and Open-to-Buy Systems

You need to be updated with every aspect of your stock so you can manage it effectively. Understanding the statistics and analysis of inventory can help you make more informed decisions, increase efficiency, and improve cash flow. Provided some best practice strategy – Pull, Push and JIT strategy. The objective is to reduce the inventory holding cost and maximize the Turns.

How do you calculate inventory turnover on a balance sheet?

- Cost of goods sold / average inventory = inventory turnover rate.

- (Quantity of goods sold / quantity of goods on hand) x 100 = sell-through rate.

- (Average inventory / cost of goods sold) x 365 = days of inventory.

In businesses with poor inventory turnover, enterprises risk being trapped with unsaleable products due to depreciation. The company may be forced to sell the goods at drastically discounted rates, lowering its earnings. Holding unsold merchandise could be a severe issue in sectors where customer tastes are continually changing or rapidly evolving technologies. Maintaining outmoded goods may result in a lack of storage capacity for currently in-demand items, resulting in lost revenue. The inventory turnover ratio is also known as the the stock turnover ratio.

A low turnover ratio will point to overstocking, obsolescence, or deficiencies within the marketing effort. If the inventory is popping over slowly, then the prices of warehouse attribution to every unit are higher. A high turnover rate might indicate inadequate levels of inventory, which can result in a loss in business because the inventory is low. The cost of sales is taken into account to be more realistic because the difference in the sales and cost of sales are recorded. Stock inventory turnover also indicates the briskness of the business.

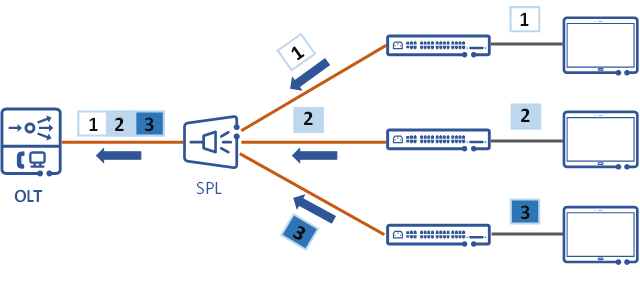

What Is an Inventory Tracking System?

The number of times a company has sold and replenished its inventory over a specific amount of time. The result implies that the stock velocity is 3 times i.e., 3 times the stock of finished goods is been converted into sales. There can also be a case where you may incur a loss on sale of inventory. Then, therein case, the value of goods sold is derived by adding the gross loss to the cost of goods sold.

JIT is most effective when the cost of maintaining inventory is high and the production model is optimized to deliver the product right in time to the customer. There are some techniques and to name few of the most popular – Consignment, ABC Inventory Management, Material requirement planning. Basis Management decision and need base, ideal technique supports optimizing Inventory Turns. Because inventory turnover could also be a business’s principal source of revenue, analysts use it to gauge product effectiveness. The average cost of items will result in sales and is calculated by dividing these two account balances in half.

Interpretation of Inventory Turnover Ratio

Besides giving the explanation of Formula of stock turnover ratio ? Has been provided alongside types of Formula of stock turnover ratio ? Theory, EduRev gives you an ample number of questions to practice Formula of stock turnover ratio ? Sales have to match inventory purchased otherwise the inventory will not turn effectively. That’s why the purchasing and sales departments are like the two sides of a coin and must relate perfectly with each other.

- In such scenarios many clients drifts towards many competitive products, to keep their required quantity fulfilled and may never turn back to the current product at all.

- Stock inventory turnover also indicates the briskness of the business.

- Open-to-buy is a stock control approach that assists businesses in determining how many goods they need.

- A relatively low inventory turnover ratio may be a sign of weak sales or excess inventory, while a better ratio signals strong sales but may also indicate inadequate inventory stocking.

- It explains how effective you are at turning stock into sales.

Divide the cost of products by the average inventory for the same period to get the inventory turnover ratio. One of the most practical ways to use inventory turnover ratios is to improve inventory management. Inventory turns are incredibly crucial for retailers and businesses that sell tangible goods. Reduced inventory stocks might result in lower overhead expenses and more profits for your company. Small-quantity buyers incur higher expenditures to maintain a high inventory turnover rate.

Inventory Turns

ClearTax offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India. ClearTax serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India. However, the average value of average inventory might refer to either cost of merchandise or stock levels.

Reducing the inventory holdings can lead to reduced overhead costs and improved enterprise profitability also. Inventory turnover ratio is very important parameter which measures how efficiently a company is handling its inventory. For the companies dealing with perishable goods and time- sensitive items, it is more critical. The companies should make efforts to keep their inventory turnover ratio high so that their stocks should be cleared frequently and they become more profitable. The inventory turnover ratio for a clothing industry may be between 5 to 8, while for the companies selling automotive parts it may lie somewhere in between 45 to 50.

It is advised to avoid such circumstances at all costs, but if you find yourself in one, provide special deals and coupons to assist sell out the old goods as rapidly as possible. It’s also worth considering conducting a particular advertising campaign to move obsolete inventory. Efficient restocking is done to order a new product before the current one sells out, keeping your business on track and reducing overstocking and surplus inventory. Furthermore, you may be able to negotiate better pricing with suppliers, which will benefit your turnover. You can find out which company has the best growth prospects by comparing its inventory turnover ratio with its peers.

Inventory Turnover in E-commerce

A company measures its inventory turnover ratio generally at the SKU (stock-keeping unit) level or the segment level to have more control over individual stock levels. Segmentation is the process of creating SKU segments according to your company’s preferences. If you wish to match supply to market demand, you might consider doing business with companies which supply small amounts of items over a long period as per your demand. This might cause your capital to be tied up with a limited number of suppliers, but you will not have to worry about supply chain issues.

Merchants may be required to make purchases more often, which will result in higher processing costs. The turnover ratio can also be calculated by dividing total revenues by stock. This comparison, however, can provide deceptively exaggerated findings because sales are typically reported at market price while inventory is documented at cost. The Inventory Turnover Ratio is also used to assess your company’s financial position.

The material and information contained herein is for general information purposes only. Consult a professional before relying on the information to make any legal, financial or business decisions. Khatabook will not be liable for any false, inaccurate or incomplete information present on the website. Inventory turnover ratio helps in knowing which products to store or reorder and how much to order.

It assists you in determining how quickly your company sells its merchandise and compares your company’s efficiency to industry norms. An inventory turnover ratio of 5 means that the company is selling its entire inventory five times in a specific period. So, basically it takes them 72 days to sell inventory (365/5). It shows that there is high demand for a company’s products and services.

Remember, a company that sells products faster, will generate higher profits for itself as well as its investors. Notice how inventory turnover ratio is closely tied to a company’s profits. The below table shows the turnover ratio of top companies in 2/3 wheeler sector. This means that HUL sells its entire inventory 6.98 times in a year.

What is inventory turnover ratio?

Inventory turnover measures how often a company replaces inventory relative to its cost of sales. Generally, the higher the ratio, the better. A low inventory turnover ratio might be a sign of weak sales or excessive inventory, also known as overstocking.

A company’s profitability is directly linked to how quickly it can sell its inventory. This includes raw materials, materials undergoing manufacturing, and finished products that can be sold. For example, shirts in clothing stores or cereal boxes at a supermarket.

The best solution is to adopt an inventory management system that can gather essential statistics, determine the economic order quantity, and find the perfect balance for your business. You can also find which products are selling best, maintain optimum stock levels, and even automate your stock management, so it is a great deal for any business. The inventory turnover ratio is calculated by dividing the cost of goods sold for a period by the average inventory for that period. Average inventory is used instead of ending inventorybecause many companies’ merchandise fluctuates greatly throughout the year. Excess old stock can drive down inventory turnover ratio, block revenue, and shoot up storage costs.

How to calculate stock ratio?

Stock to sales ratio = Average stock value / Net sales value

This can be turned into a percentage by multiplying it by 100. To calculate average stock value, simply add your beginning inventory value and ending inventory value together, and then divide that sum by 2.