- And additionally, individuals may use their mortgage proceeds to finance some thing they could you desire. Capable pay the overdue debts otherwise go shopping for this new attire.

- In the long run, an individual Monetary Coverage Bureau assists regulate the industry, providing result in the equipment secure.

Of many You.S. people find it difficult fulfilling financing conditions as they are underbanked and you can lack access to a keen ABA Navigation Number. Particular companies may possibly not be ready to aid you if you lack a checking account.

Typically, bank account are needed while they illustrate your ability to pay straight back the borrowed funds. Rather than a merchant account, a creditor never make an automated withdrawal if borrowing are owed. Because of this, indicating you are the right companion will be tough.

A unique Chance-Research Model

This matter is so well-known one lenders are beginning to help you to evolve its risk-assessment patterns. Specific companies tends to be willing to present even more versatile standards and commission timetables. Also, capable offer ways to discover the loan you to definitely forgoes conventional electronic bank accounts.

When you have a savings account, your chances of in search of the ideal capital partner seem to be large https://getbadcreditloan.com/payday-loans-ia/fort-madison/ than just they will getting or even. If you are a bank checking account is recommended, a savings account reveals financiers one to finance companies haven’t prohibited you against service.

Register Now let’s talk about a family savings

If you don’t have a checking account, you ought to open you to when you is also. Usually, they do not carry a lot more can cost you or costs. At the same time, your ount about membership. Finance companies tend to have a necessity to keep you to definitely open while making yes your balance cannot feel bad.

You might prevent that it by means overdraft protection and you can informing their monetary institution to turn off overdrawing functionalities. More often than not, overdrawing properties are when banking institutions invest in defense costs removed regarding your bank account into the understanding that you will spend a small interest payment. For individuals who exit overdrawing towards as well as your membership gets into the brand new negative, the lending company can get thought you unpaid when the too much time entry.

Things to Learn about Payday loans You to Take on Offers Accounts?

The standard features from a preliminary-identity mortgage will stay the same whether or not you utilize a savings membership otherwise a checking account: your acquire a little bit of currency to own a short period into the comprehending that you will pay back the loan proceeds.

These funding could be far more quick to acquire than a charge card or an unsecured loan. When requesting credit cards or an unsecured loan regarding the financial, brand new boss could possibly get work on a credit score assessment to assess the latest applicant’s credit rating. A credit history is generally determined of the one of the leading bureaus, Equifax, Experian, and you can TransUnion. These types of credit bureaus imagine four main items to assess a cards score:

- what number of account that the candidate holds

- the type of account your applicant provides

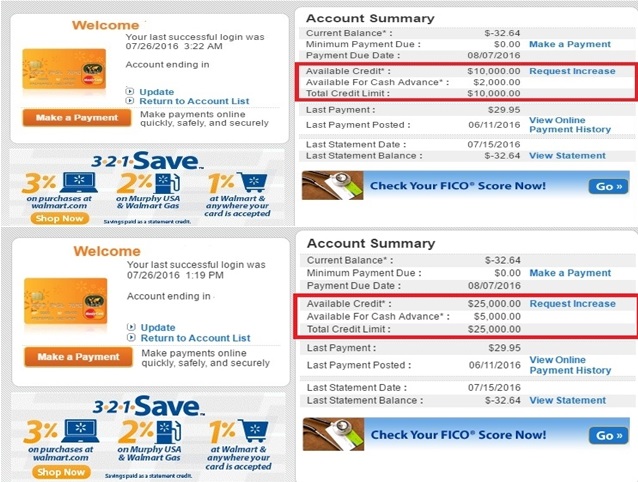

- brand new applicant’s used and you will available credit

- along this new applicant’s credit score

- this new applicant’s percentage history

Interest rates

The latest annual percentage rate regarding advance financing will likely be greater than those of antique funding measures. Also they are delivered during the an initial schedule. It means there are a shorter time to fund your loan, no matter if your following salary isnt sufficient to protection the fresh balance. This means that, particular consumers see it must catch-up for the late payments and amassed attention, in fact it is a painful activity.

Rollovers

As well as noteworthy is actually rollovers plus the repayments that is included with them. If you can’t pay your loan promptly, your financier will get let you offer the latest due date getting an enthusiastic additional percentage. Such charges can add up over the years.